Post Stock Valuation

FAP is able to post Stock Valuation figures at the end of each period.

At the end of …

- period 1, post the opening stock while reversing last the year closing stock valuation.

- each Period, post recalculated closing stock valuation while reversing the closing stock valuation for last period.

Before you begin

To Post Stock Valuation figures as part of the Sales Ledger Year End

- Go to Accounts > Sales Ledger> End > Year End.

- Click Next to continue.

- Tick the “Post stock valuation figures (Published Only)” option to value and post the Published titles as part of the sales period end process. Otherwise leave un-ticked.

- Tick the “Post stock valuation figures (Work In Progress)” option to value and post the Not Yet Published titles as part of the sales period end process. Otherwise leave un-ticked.

- Confirm the codes for the stock accounts then click Next to continue.

- Confirm the stock valuation figures then click Next to continue.

- To continue click ‘Next’.

This action will

- post the closing stock valuation for period 12

- CREDIT: Closing Stock Acct (Cost of Sales)

- DEBIT: Stock Acct (Balance Sheet)

- post the opening stock for next year period 1

- CREDIT: Stock Acct (Balance Sheet)

- DEBIT: Opening Stock Acct (Cost of Sales)

To Post Stock Valuation figures as part of the Sales Ledger Period End

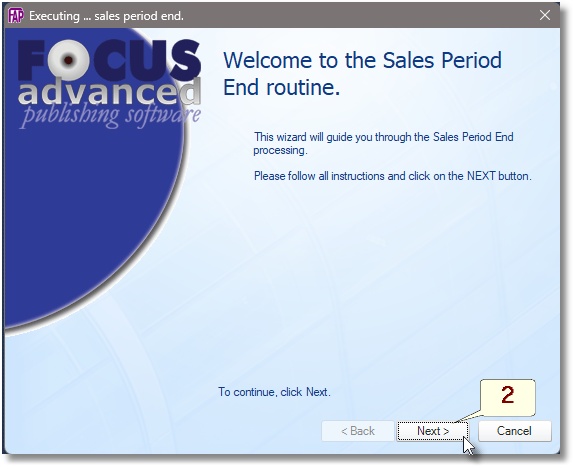

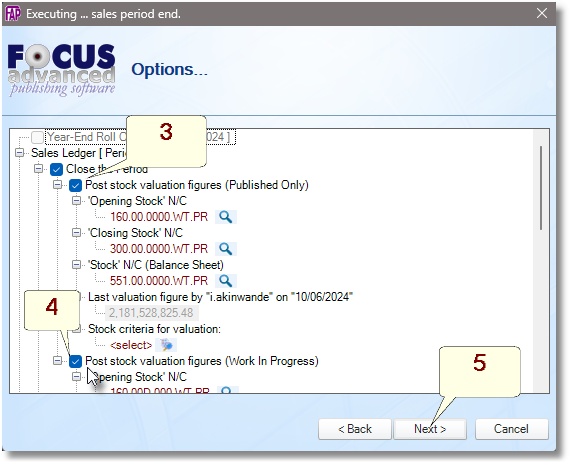

- Go to Accounts > Sales Ledger> End > Period End.

- Click Next to continue.

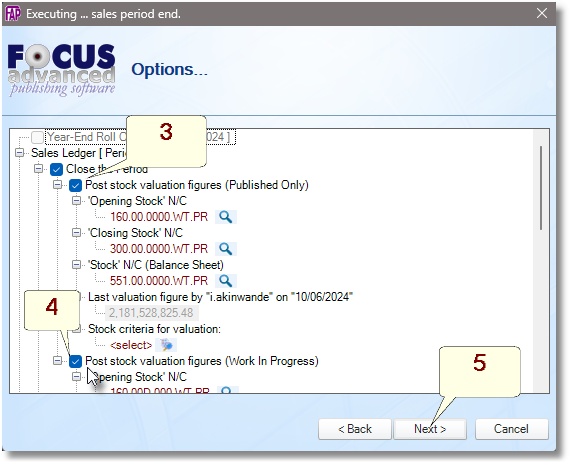

- Tick the “Post stock valuation figures (Published Only)” option to value and post the Published titles as part of the sales period end process. Otherwise leave un-ticked.

- Tick the “Post stock valuation figures (Work In Progress)” option to value and post the Not Yet Published titles as part of the sales period end process. Otherwise leave un-ticked.

- Confirm the codes for the stock accounts then click Next to continue.

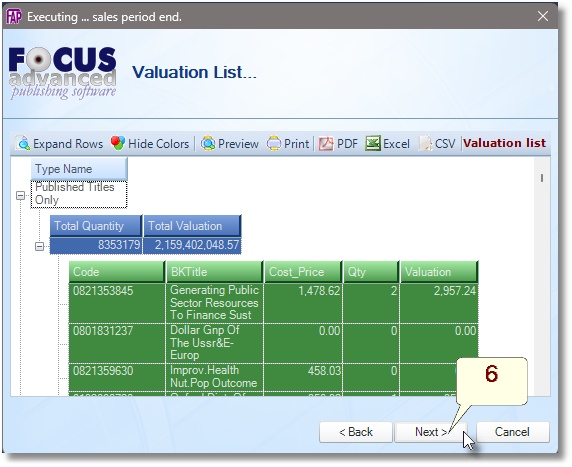

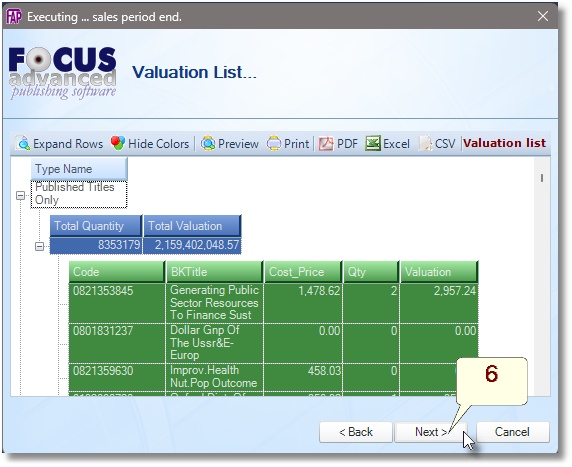

- Confirm the stock valuation figures then click Next to continue.

- To continue click ‘Next’.

This action will

- post the closing stock valuation for active period

- CREDIT: Closing Stock Acct (Cost of Sales)

- DEBIT: Stock Acct (Balance Sheet)

- reverse the closing stock for last period

- CREDIT: Stock Acct (Balance Sheet)

- DEBIT: Closing Stock Acct (Cost of Sales)

Create a New Order

Release an Order

Edit an Active Order

Reverse a Done Order

Batch Release and Reprint

Dues invoicing (Backorders)

SOP Error Log

Returns System

Add New, Edit Title Records

Receive Stock (Goods-In) to a Location

Send Out Consignments or Transfer Stock

Process Sales Orders

Do Stocktake

Process Printer/Supplier Invoice

Calculate unit costs

Post Stock Value to Cost of Sales

Add, Classify Edit Accounts

Post Journals

Cash Book

Transfer Money

Post Budgets

Setup Control Accounts

Cost of Sales Overview

Post costs from Purchases

Post Direct Job Transactions

Calculate unit costs

Job Profile / Enquiry

Calculate Royalty

Print, Email Royalty Statements

Post Royalty Payments

Withholding Tax on Royalty

Add Author Records

Set Royalty Rates

Set Rights Royalty