Calculate Unit Costs

You can either choose to enter unit cost manually per title, or have the system calculate unit cost per title from actual and direct costs put through the system.

The Job costing module, when activated, records the various costs of the book, as entered in the actual supplier invoices and credit notes put through in the purchase ledger. It also captures direct costs i.e. in-house or already-paid-for costs.

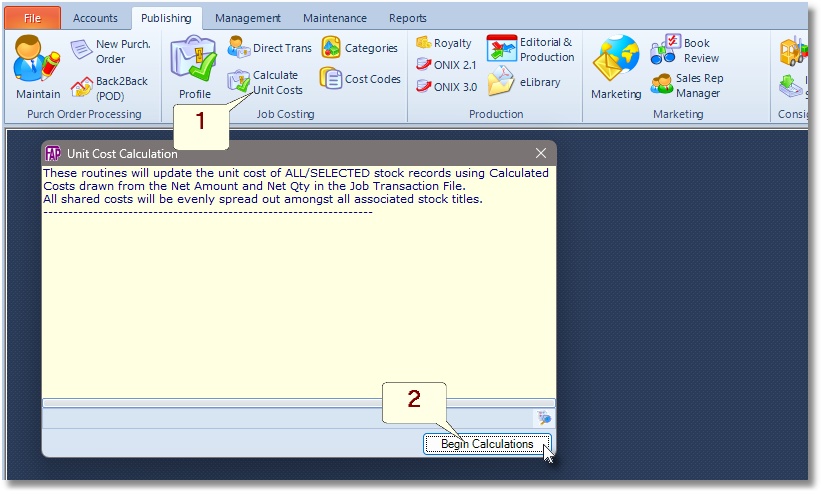

To calculate unit cost

- Select Publishing> Job Costing > Calculate Unit Costs

- Click Begin Calculations

Always re-calculate unit costs before you take a valuation of your stock at the end of a financial period or indeed at any point, to refresh all the stock unit costs. This is important to incorporate all new invoices entered since the last run.

The unit cost is calculated based on the following rules.

- Included in the Unit Cost calculation: Unit Cost is calculated using the total value of all the job transaction for which the unit cost code is marked as ‘Included in the Unit Cost calculation’

- Print Cost Code: Total quantity per print run is calculated from all job transactions where the unit cost codes are marked as ‘Print Cost Code’.

- Split Edition Unit Costs: Where both hard-back and paper-back versions are produced for a product, FAP Job Costing will apportion all non-printing costs per version and then add on edition-specific printing costs to arrive at the accurate unit cost per edition.

Methods of Unit Cost

The procedure to calculate unit cost depends on your choice of the unit cost method. Focus enables you to apply one of three methods of unit cost.

Always run the unit cost calculation routine right before you take a valuation report of your stock or at the end of a financial period, because it refreshes all the stock unit costs by incorporating all new invoices entered since the last run.

Calculating Unit Costs – Current Inventory Method

This method calculates unit cost per title, based on the current inventory. It adds the closing stock value for last year (same as opening stock value for current year) weighted by the closing quantity for last year (same as opening stock quantity for current year), to the current year purchases value, weighted by the current year purchases quantity.

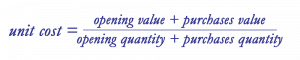

Unit cost is calculated on the basis of the formula

where

- Opening value= last year closing value, held in the “Stock_Rec.LastYearClosingAmount” field, as updated at year end.

- Purchases Value= total value of curent year purchases, derived from invoices put through to Job_Trans table

- Opening Quantity= last year closing quantity, held in the “Stock_Rec.LastYearClosingQuantity” field, as updated at year end.

- Purchases Quantity= total quantity of curent year purchases, derived from invoices put through to Job_Trans table, where the unit cost codes are marked as ‘Print Cost Code’.

Calculating Unit Costs – Weighted Average Method

Unit cost is calculated on the basis of the formular

where

- Total Life Value= Unit Cost is calculated using the total value of all job transactions, for the life of the book, for which the unit cost code is marked as ‘Included in the Unit Cost calculation’

- Total Life Quantity= Total quantity per print run is calculated from all job transactions, for the life of the book, for which the unit cost codes are marked as ‘Print Cost Code’.

To calculate unit cost

- Select Publishing> Job Costing > Calculate Unit Costs

- Click Begin Calculations

Calculating Unit Costs – Last Cost Method

To calculate unit cost based on only the last costs

- Select Publishing > Job Costing > Profile

- Select a stock code

- Then click the Calculate Cost button to manually close-off unit cost per title

NOTE

- This is done on a title-by-title basis.

- By using a system of Active and Closed Job Transactions to determine Last Print Costs, this option allows you to determine when all the relevant costs have arrived and to trigger a unit cost calculation.

- Once the Last Cost option is triggered, as shown above, the new unit cost will be based on the active-job-transactions only.

- You will be required to confirm the new unit cost figure before it is committed to the database. Focus will write the new unit cost, and then mark all relevant transactions as closed.

- Thereafter the new/active costs can then be collected as Active, and will be used in the next unit cost calculation.

- Note that for existing stock this means that unit cost calculation is derived from reprints and that origination costs, for instance, are effectively written off.

- Due largely to significant differences in prices over time, the trend has been to opt for alternative methods of calculating unit cost based on last cost, away from the weighted average method.

Create a New Order

Release an Order

Edit an Active Order

Reverse a Done Order

Batch Release and Reprint

Dues invoicing (Backorders)

SOP Error Log

Returns System

Add New, Edit Title Records

Receive Stock (Goods-In) to a Location

Send Out Consignments or Transfer Stock

Process Sales Orders

Do Stocktake

Process Printer/Supplier Invoice

Calculate unit costs

Post Stock Value to Cost of Sales

Add, Classify Edit Accounts

Post Journals

Cash Book

Transfer Money

Post Budgets

Setup Control Accounts

Cost of Sales Overview

Post costs from Purchases

Post Direct Job Transactions

Calculate unit costs

Job Profile / Enquiry

Calculate Royalty

Print, Email Royalty Statements

Post Royalty Payments

Withholding Tax on Royalty

Add Author Records

Set Royalty Rates

Set Rights Royalty