Period & Year End Activities

At the end of each Period you need to close the

Then, at the end of the Year you need to close the

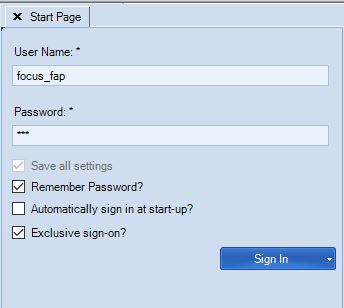

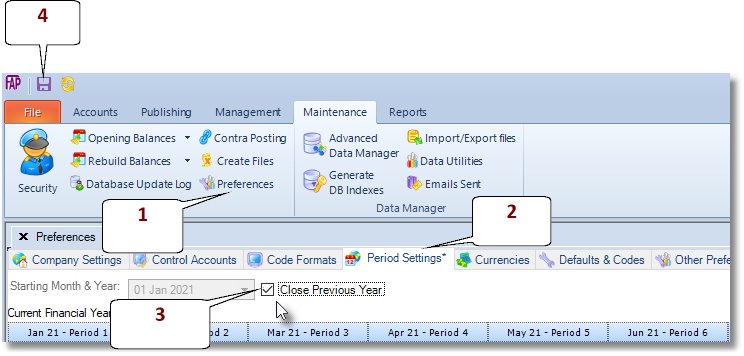

- Before you can perform period and year end routines you need to be exclusively signed on.

- Before you can perform year end routines for the current year, you need to close the previous year.

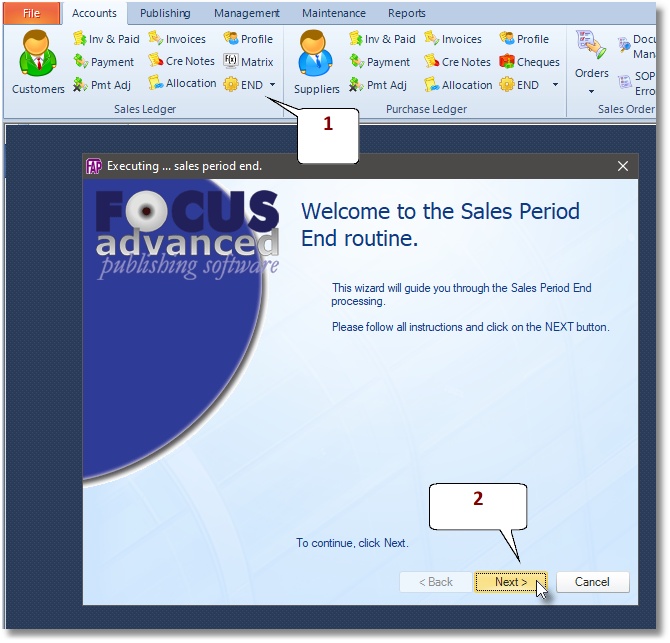

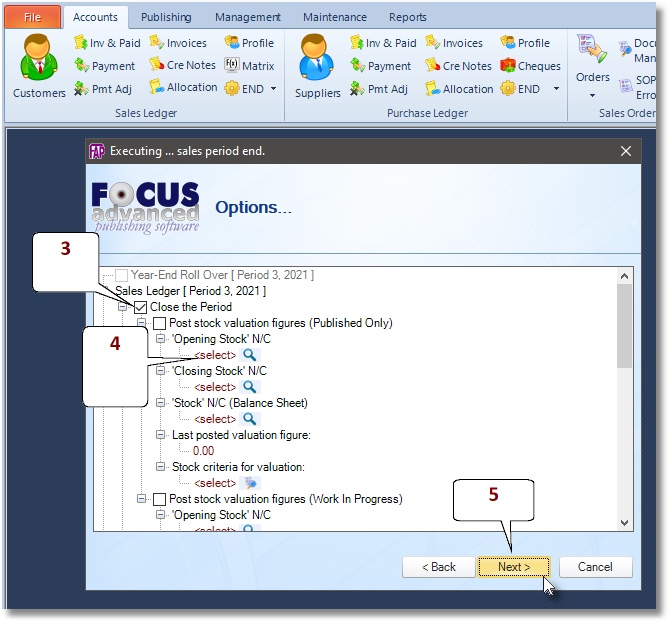

Sales Ledgers Period End

- Go to Accounts > Sales Ledger> End > Period End .

- To continue click Next then follow the instructions.

- If you want Focus to post the stock valuation figure as part of the sales period end process, then tick the option “Post stock valuation figures”. Otherwise leave un-ticked.

- Confirm the codes for the stock accounts then continue.

- Click ‘Next’ to Confirm the stock valuation figures.

- To continue click ‘Next’.

This action will

- close the sales ledger

- update accounts’ brought-forward balances

- reset periodic allocations in transactions files

- batch post transactions to nominal ledger and

- trigger the start of the next period

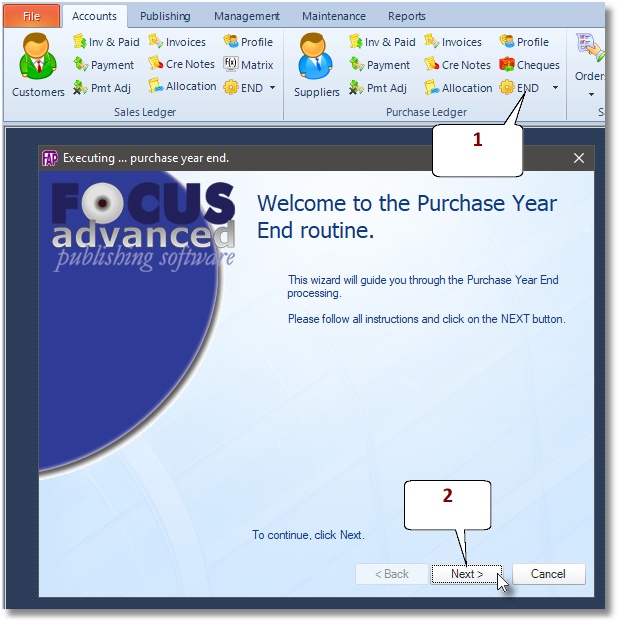

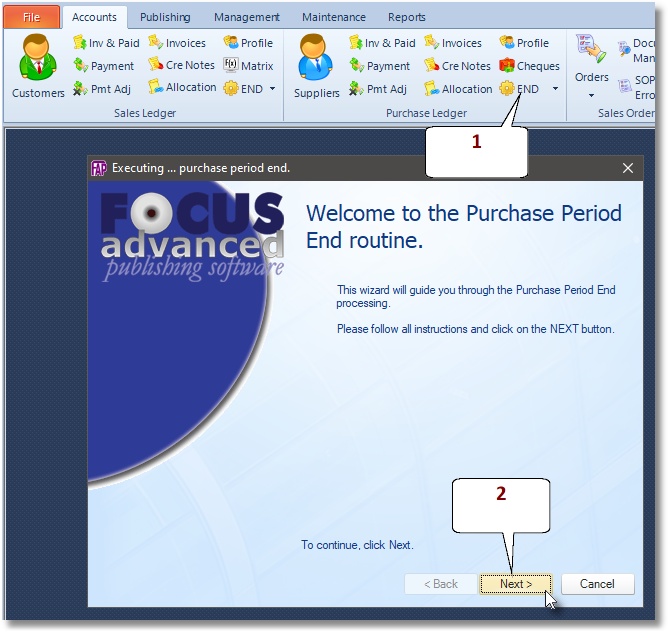

Purchase Ledger Period End

- Go to Accounts > Purchase Ledger> End > Period End .

- To continue click Next then follow the instructions.

This action will

- close the purchase ledger

- update accounts’ brought-forward balances

- reset periodic allocations in transactions files

- batch post transactions to nominal ledger and

- trigger the start of the next period

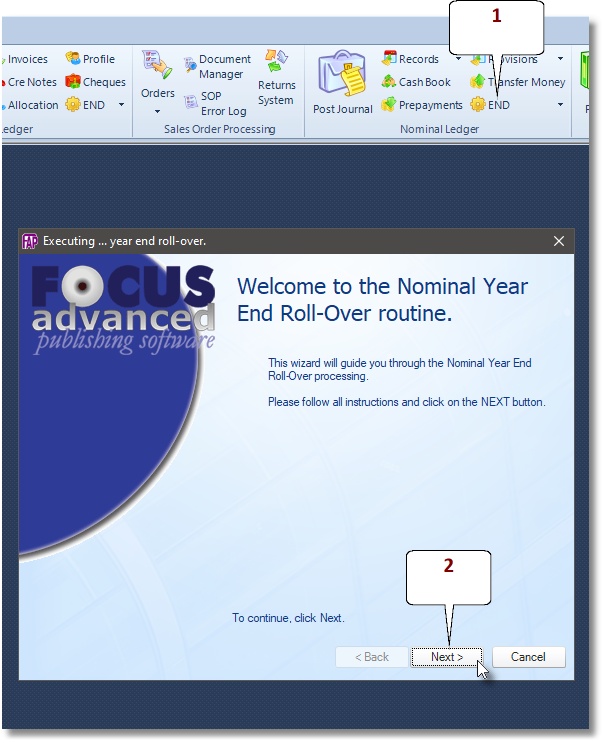

Nominal Year End Roll-over

Year End Roll-over – to be run at Period 12, to open up a new financial year, and mark the current year as Last.NOTE: this routine does not close the Sales or Purchases, but allows both ledgers to continue to post into the current year, and into the period 1 only, of the new year.

- Go to Accounts > Nominal Ledger> End > Year End Roll-over.

- To continue click Next then follow the instructions.

This action will

- close the nominal ledger

- scan all nominal codes to confirm data integrity and conformity of balances across periods

- move down by one financial year and initialize all nominal codes

- calculate and post the profit / loss figure to retained earning account

- return all profit / loss nominal codes to zero

- update brought-forward balances for the balance sheet nominal codes and

- trigger the start of a new financial year.

Note: Posting to both years

After you have run the year end roll-over, the sales and purchases ledgers remain open. At this point, you are able to post sales invoices into both years. This enables you to continue to enter backlog of invoices and payments meant for the old year, even as you have started entering invoices and payments for the New Year.

You are able to post purchase invoices into the old year only.

You are also able to post journal entries into both the current and last years.

However, when you close the sales ledger year or purchases ledger year, you will no longer be able to post sales or purchase transactions to last year.

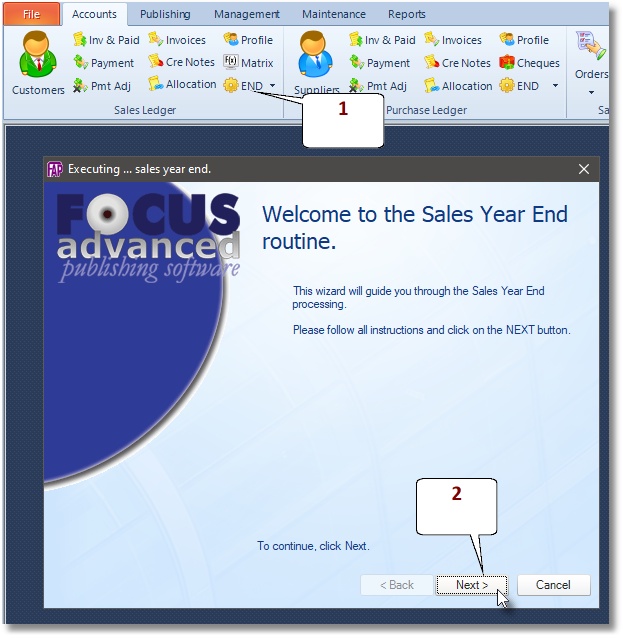

Sales Ledgers Year End

Click on this option to post all outstanding Sales transactions into the Nominal Ledger, and close the current Year, where the current Period is 12 or Year End.

- Go to Accounts> Sales Ledger > End > Year End

- To continue click Next then follow the instructions.

- You can choose to post stock valuation as part of the sales year end routine.

Post Raw Materials Stock Adjustment figures, if you use Focus to manage your raw materials purchases and usage

If you use Focus to manage your raw materials purchases and usage, then as part of your year end activities, your may want to account for adjustments in the Raw Materials Stock quantities by entering direct Job Cost transactions as follows.- Go to Publishing > Job Costing > Direct Transactions

- Select a stock code

- Select a PRINTING cost code e.g. RMPL

- Edit the Details appropriately e.g. Year End Stock Adjustment YYYY/YY

- Enter the quantity

- Enter amount

- Click the Save button to finish

Import Stock-take figures

To import stock take values from an external comma separated values (csv) file,- Prepare COMMA-SEPARATED (CSV) files for Raw Materials and Finished Goods per location, such that column A contains the Stock Code/ISBN and column B contains the stock take quantities, without the column header line.

- Go to Accounts > Stock Ledger > Stock Take > Electronically

- Then follow the instructions

Post Stock Valuation to nominal ledger

Depending on the formula you choose to base the Cost of sales, we provide Stock Valuation reports to enable you post the appropriate journals to nominal. In general there are two widely accepted Cost-of-sales formulas- Cost of sales = Opening Stock + Purchases – Closing Stock

- Cost of sales = Unit Cost * Quantity

- At the beginning of the year, the balance sheet Stock account is credited while the PL Opening Stock account is debited with the stock valuation

- During the year/period, purchase invoices credit the Creditor control account and debit purchases in ‘cost of sales’ group of accounts

- At year-end/period-end, the Closing Stock account is credited while the Stock account is debited.

- On the Profit and Loss account statement, Focus presents the cost of sales at run time on the basis of the formula: Cost of sales = Opening Stock + Purchases – Closing Stock

Archive Report: Stock, Customer, Rep and Supplier Schedules and the Aged Debtors Analysis

Print the following real-time reports to PDF or hardcopy, then put away for reference.- Stock Schedules

- Customer Schedules

- Rep Schedules

- Supplier Schedules

- Aged Debtors Analysis report