Post costs

The Job costing module is able to calculate unit cost per title from actual and direct costs put through the system.

The Job costing module, when activated, records the various costs of the book, as entered in the actual supplier invoices and credit notes put through in the purchase ledger. It also captures direct costs i.e. in-house or already-paid-for costs.

As you enter purchase invoices and credit notes, Focus posts to the purchase ledger, as well as posts to the job costing module, if you specify the stock code, quantity and cost code; thereby assembling all the costs involved in the production of a title.

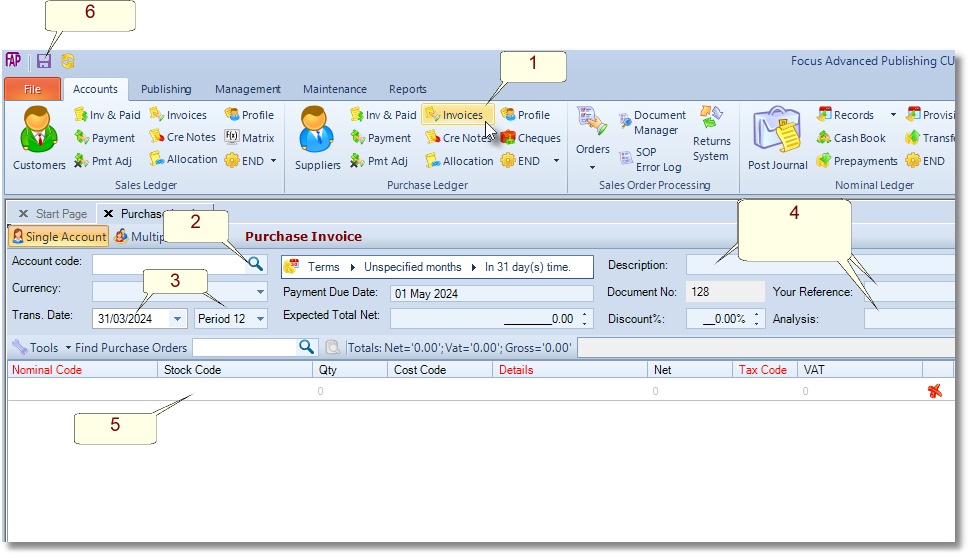

To Process a Supplier’s Invoice

- Go to Accounts > Purchase Ledger > Invoices

- Find a supplier in the Account Code box

- Check that the transaction Date and Period are correct.

- Enter the transaction Description, Reference, Analysis code and Invoice Total amount.

- Enter the following line details

- Nominal Code: This acct will be debited

- Stock Code: Required for Unit Cost calculation, otherwise optional

- Stock Qty: Required for Unit Cost calculation, otherwise optional

- Cost Code: Required for Unit Cost calculation, otherwise optional

- Net: Invoice Line Amount

- Click the Save button to post the transaction to the purchase ledger and job costing.

Create a New Order

Release an Order

Edit an Active Order

Reverse a Done Order

Batch Release and Reprint

Dues invoicing (Backorders)

SOP Error Log

Returns System

Add New, Edit Title Records

Receive Stock (Goods-In) to a Location

Send Out Consignments or Transfer Stock

Process Sales Orders

Do Stocktake

Process Printer/Supplier Invoice

Calculate unit costs

Post Stock Value to Cost of Sales

Add, Classify Edit Accounts

Post Journals

Cash Book

Transfer Money

Post Budgets

Setup Control Accounts

Cost of Sales Overview

Post costs from Purchases

Post Direct Job Transactions

Calculate unit costs

Job Profile / Enquiry

Calculate Royalty

Print, Email Royalty Statements

Post Royalty Payments

Withholding Tax on Royalty

Add Author Records

Set Royalty Rates

Set Rights Royalty