Royalty Rates

Important: Before entering the author royalty percentage per title; please read and understand how each royalty mode may help fulfil your author’s contract requirement.

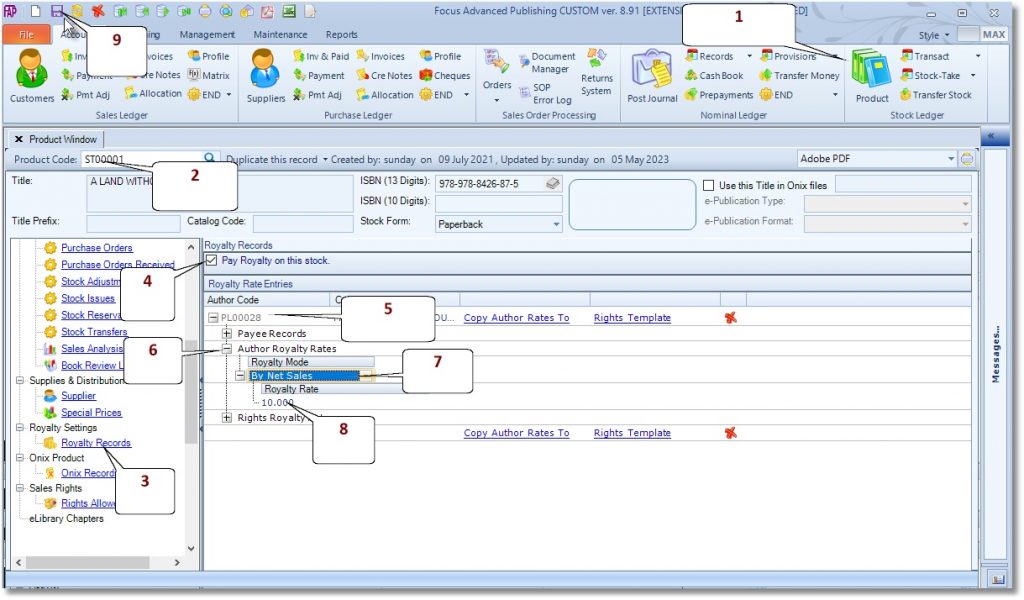

To setup Royalty Rates on the Product window

- Go to Accounts > Stock Ledger > Product

- In the Product Code box select stock title code

- Select the Royalty Records page

- Tick the Pay Royalty on this stock box

- In the Author Code field select an author code

- Click (+) sign beside Author Royalty Rates. The default royalty mode is ‘Net Sales’

- Select a royalty mode which matches your contract with the author. Focus is able to calculate eight different types of Royalty modes.

- Under the Royalty Rates column enter the parameters for the selected royalty mode.

- Click the Save

To setup Royalty Rates on the Royalty window

- Go to Publishing> Royalty

- On the Royalty Ratespanel select stock title code

- Tick the Pay Royalty on this stockbox

- In the Author Codefield select an author code

- Click (+) sign beside Author Royalty Rates. The default royalty mode is ‘Net Sales’

- Select a royalty mode which matches your contract with the author. Focus is able to calculate eight different types of Royalty modes.

- Under the Royalty Ratescolumn enter the parameters for the selected royalty mode.

- Click the Save

Royalty Modes

Focus lets you setup any of 8 royalty contract types.

| CODE | MODE | DESCRIPTION |

|---|---|---|

| 0 | Net Sales | This is calculated as a percentage of the net sales. This is by far the most popular royalty type, as it allows the publisher and author to share in the huge discounts given to supermarkets, bookshop chains and on-line retail giants. |

| 1 | Quantity Sold | The royalty percentage is based on the total quantity sold (minus gratis copies) * selling price. |

| 2 | Variable Quantity Sold | Here the royalty percentage is pegged to the escalating/breakpoints of the quantity sold, to determine the applicable royalty %. But, the resultant royalty% is then applied to the net sales, per breakpoint. Note: There is no limit to the number of breakpoints, which can be set per author per title |

| 3 | Discount Bands (High/Low Discount bands) | Here we break each sale line into a HIGH or LOW discount band, before we determine the royalty rate applicable. Usually, a HIGH discount is from 50% to 100% and LOW discount band is from 0% to 49.99%. |

| 4 | Variable Net Sales | Here the royalty percentage is pegged to the escalating/breakpoints of the net sales (i.e. Selling Price * Quantity (less discount)), to determine the applicable royalty %. But, the resultant royalty% is then applied to the net sales, per breakpoint. Note: There is no limit to the number of breakpoints, which can be set per author per title |

| 5 | Geographical Area’s Net Sales | The royalty-rate applicable is determined by the cumulative/life net-sales range per geographical Area, it falls under. The resultant royalty% is then applied on the net sales for the period. There is no limit to the number of breakpoints, which can be set per author per title. |

| 6 | Geographical Area’s Quantity Sold | The royalty-rate applicable is determined by the cumulative/life quantity sold range per geographical Area, it falls under. The resultant royalty% is then applied on the net sales for the period. There is no limit to the number of breakpoints, which can be set per author per title. |

| 7 | Discount Ranges | To help meet the demands of the most challenging author contracts, especially in trade publishing, we introduced a NEW royalty type called “Discount Range”. It allows the user to specify the applicable royalty rate by discount range, and depending on the accumulated-quantity-sold and where it fits in the defined Quantity-sold ranges per geographic region. After specifying the escalated discount and the quantity-sold ranges per geographic region, the system also presents the user a choice of 2 royalty-calculation methods: by (1) Net Receipt or (2) Published Price. Note: Generally, in trade-publishing, Local Sales are usually based on published price/RRP, whereas Export Sales are based on Net Receipt. |

Create a New Order

Release an Order

Edit an Active Order

Reverse a Done Order

Batch Release and Reprint

Dues invoicing (Backorders)

SOP Error Log

Returns System

Add New, Edit Title Records

Receive Stock (Goods-In) to a Location

Send Out Consignments or Transfer Stock

Process Sales Orders

Do Stocktake

Process Printer/Supplier Invoice

Calculate unit costs

Post Stock Value to Cost of Sales

Add, Classify Edit Accounts

Post Journals

Cash Book

Transfer Money

Post Budgets

Setup Control Accounts

Cost of Sales Overview

Post costs from Purchases

Post Direct Job Transactions

Calculate unit costs

Job Profile / Enquiry

Calculate Royalty

Print, Email Royalty Statements

Post Royalty Payments

Withholding Tax on Royalty

Add Author Records

Set Royalty Rates

Set Rights Royalty