Making Tax Digital

If you are a VAT-registered business with a taxable turnover above the VAT threshold, then you are now required by HMRC to use the Making Tax Digital service to keep records digitally and use software to submit your VAT returns for VAT periods that started on or after 1 April 2019.

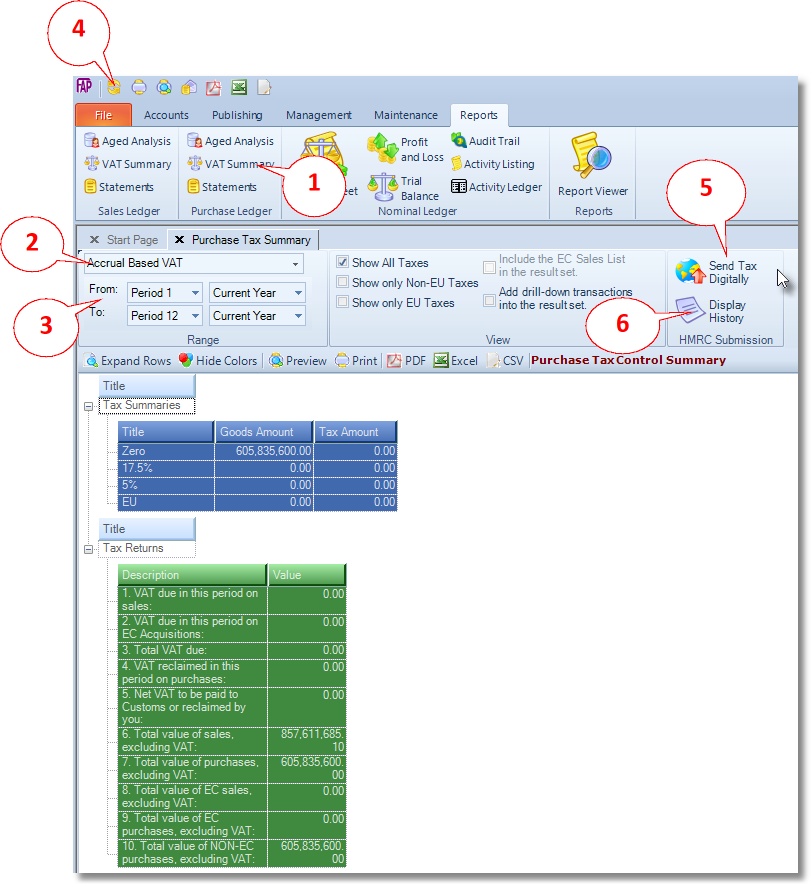

To this effect, we have introduced a new button called “Send Tax Digitally”, in the “VAT Summary” windows, as shown in the video. The button activates a wizard that will guide you through the submission process.

Submit VAT Returns to HMRC Digitally

- Print and approve the VAT Returns, as you did before

- Submit the approved VAT Returns to HMRC, by clicking the “Send Tax Digitally” button.

Submit the approved VAT Returns to HMRC

- Go to Reports > Purchase Ledger > VAT Summary. Or go to Reports > Sales Ledger > VAT Summary.

- Select type of VAT: Accrual Base VAT or Cash Based VAT. The default is Accrual Base VAT.

- Select the VAT Year and Period you wish to pay for.

- Click the Refreshbutton to display calculated VAT from your digitally held transactions.

- Click the Send Tax Digitallybutton and follow the instructions.

- Click the Display Historybutton to view past submissions to HMRC.

Activate FAP for Live-Submission of VAT Returns to HMRC

- Go to the Maintenance > Preferences

- On the Company Settings tab, enter your VAT Registration Number (VRN), without spaces.

- Tick the option “Is Registered for MTD (VAT)”

- Click the Savebutton to finish.

Register with HMRC

First you must register with HMRC for Making Tax Digital (MTD) for VAT

- Click here:if you already have your Government Gateway user ID and Password.

- Otherwise click hereto Create sign in details.

Create a New Order

Edit an Order

Batch Release and Reprint

Dues invoicing (Backorders)

SOP Error Log

Returns System

Add New, Edit Title Records

Receive Stock (Goods-In) to a Location

Send Out Consignments or Transfer Stock

Process Sales Orders

Do Stocktake

Process Printer/Supplier Invoice

Calculate unit costs

Post Stock Value to Cost of Sales

Add, Classify Edit Accounts

Post Journals

Cash Book

Transfer Money

Post Budgets

Setup Control Accounts

Cost of Sales Overview

Post costs from Purchases

Post Direct Job Transactions

Calculate unit costs

Job Profile / Enquiry

Calculate Royalty

Print, Email Royalty Statements

Post Royalty Payments

Withholding Tax on Royalty

Add Author Records

Set Royalty Rates

Set Rights Royalty