Withholding Tax on Author Royalty

Royalty is a form of income to the author and is subject to withholding tax, collected at source, by the publisher, on behalf of the authorities, subject to the publisher’s country custom requirements.

Country Withholding Tax laws

Withholding Tax laws vary from country to country. But in general, withholding tax does not apply if the book is sold outside the publisher’s area/country.

Because customs laws require that withholding tax is charged on sales made to customers who reside in the publisher’s country and not outside it, in Focus, if a book is sold to a customer whose country is not same as the country of the Publisher, as defined in the Native Country (Maintenance > Preferences > Currency/Rates) withholding tax is not applied on such a transaction.

In order to meet this customs legal requirement to recognize the country of each customer that bought the book and to apply the seven different types of royalty calculations available in Focus (some of which are based on escalating percentages) note that the system must compute withholding tax on a transaction by transaction basis, and not on the final royalty figure.

To set the control account for Withholding Tax

- Go to Maintenance> Preferences

- Select Control Accounts

- For Withholding Tax click in the Nominal Code column to set the control account

- Click the Save button

To set the general Withholding Tax Rate

- Go to Maintenance> Preferences

- Select Other Preferences

- Then go to Stock Ledger> Section One

- In the General Withholding Tax Ratebox, enter the general withholding tax rate

- Click the Savebutton

The withholding tax per royalty is displayed on the respective Multi-title statement. The total withholding tax figure is posted automatically to the Withholding Tax Control Account.

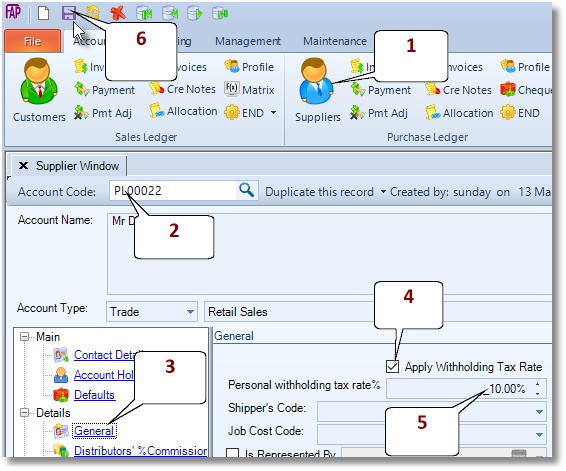

Apply withholding tax on author record

- Go to Accounts> Purchase Ledger > Suppliers

- Select an author record

- Go to Details> General

- Tick the ‘Apply withholding tax rate‘ box

- In the ‘Personal Withholding Tax Rate’ box, enter the personal Withholding Tax Rate. To use the general Withholding Tax Rate leave it at zero (0)

- Click the ‘Save’ button

The system applies withholding tax during the computation of royalties based on the general Withholding Tax Rate or personal Withholding Tax Rate held in the system.

Create a New Order

Release an Order

Edit an Active Order

Reverse a Done Order

Batch Release and Reprint

Dues invoicing (Backorders)

SOP Error Log

Returns System

Add New, Edit Title Records

Receive Stock (Goods-In) to a Location

Send Out Consignments or Transfer Stock

Process Sales Orders

Do Stocktake

Process Printer/Supplier Invoice

Calculate unit costs

Post Stock Value to Cost of Sales

Add, Classify Edit Accounts

Post Journals

Cash Book

Transfer Money

Post Budgets

Setup Control Accounts

Cost of Sales Overview

Post costs from Purchases

Post Direct Job Transactions

Calculate unit costs

Job Profile / Enquiry

Calculate Royalty

Print, Email Royalty Statements

Post Royalty Payments

Withholding Tax on Royalty

Add Author Records

Set Royalty Rates

Set Rights Royalty